Celebrate good times: The European private equity deal market achieves highest total value since 2007 and exits are at an all time high

An M&A bonanza and high stock market valuations helped European private equity companies to a record year for exits and the highest deal values since 2007.

The total exit value in Europe stands at a new high of €153.2bn (£112bn). IPOs and trade sales (where the company is taken over by another business operating in same sector) have been particularly strong and are both at record levels of €48.7bn and €63.8bn respectively, according to data from the Centre for Management Buyout Research (CMBOR), compiled for buyout firm Equistone.

An exit is when a private equity company ends its investment in a company and returns the money to its investors, normally by selling it on to a new owner (either another private equity house or a trade sale) or floating the business on the public market and selling its stake that way.

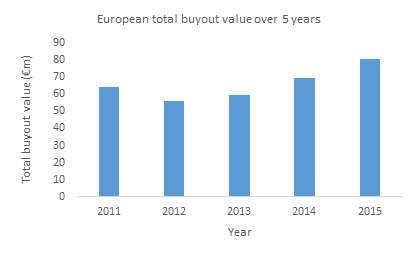

The total value for European private equity deals in 2015 stands at €80.9bn, the highest yearly total since 2007.

While this year's figure is considerably less than 2007's high of €172.9bn, 2015 did see the highest average value per transaction since 2007, standing at €131.6m versus €171.1m.

The research shows that since 2013, the value of private equity deals in Europe has increased by about €10bn each year.

Source: CMBOR

2015's private equity deal values are the fourth highest on record behind 2007, 2006 and 2005 respectively. There were 19 deals worth more than €1bn in 2015, compared to 13 the year before, and deals of that size accounted for almost half the total market.

Christiian Marriott, investor relations partner at Equistone, said:

2015 clearly shows that big deals are back, as shown by the highest average deal value and number of billion plus deals since 2007. With the final quarter proving strong for both deals and exits, the European private equity market will start 2016 with positive momentum.

The UK's private equity market has led the way, with €26.8bn-worth of deals, up from €21bn last year, and more than double the total value of the German market, at €11.9bn, which is the next biggest market. The number of deals in the UK is down on last year at 197, from 236, suggesting that it is the big deals such as Virgin Active (€1.8bn) and New Look (€2.6bn) that boosted the market.

2015 has also seen the return of the highly leveraged deal, average debt in a deal worth more than €100m+ was at 58.9 per cent and equity slipped below 40 per cent for the first time since 2007 standing at 39.4 per cent.

Marriott added:

The European private equity exit market also had an outstanding 2015, achieving a record total value. While volatility in European markets stifled the IPO activity in the previous two quarters, a flurry of big IPOs at the end year, including Worldpay and Scout24, helped the boost the value to a record number. However, it has not all been about IPOs, as there have been more exits via trade sales than floatations amongst the year’s top 10 largest deals.