Investors starting to warm to emerging markets again

Attitudes towards investing in emerging markets have improved markedly over the last month, according to survey figures published today by one of the UK’s biggest lenders.

Lloyds Bank’s investor sentiment index for emerging market shares climbed 8.47 points to a score of 5.32. The score was derived from a survey of 4,500 people.

However, sentiment towards emerging market investments is still lower than it was this time last year.

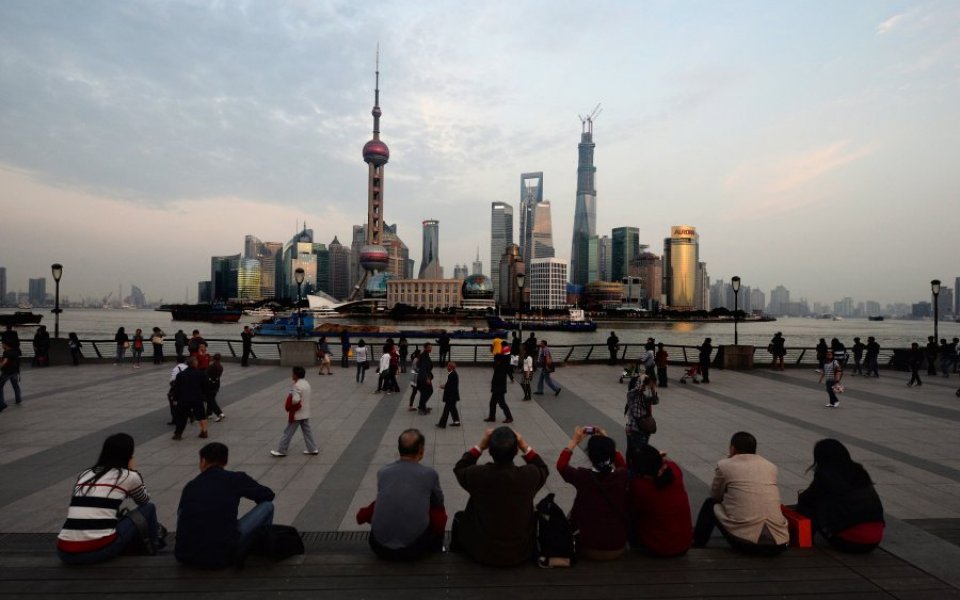

Lloyds Bank said the monthly improvement was due to stabilisation in China thanks to action from its central bank.

Investors were spooked by a worse-than-expected slowdown in China’s economic growth this year, while the Chinese stock market suffered a massive boom-bust phase that sent shockwaves through global markets.

Ashish Misra, head of portfolio specialists at Lloyds Bank Private Banking, said: “Positive policy interventions from central banks are helping to provide strong performances for many asset classes at the moment. As a result, potential performance seems to be in a relatively positive place looking ahead towards the end of the year.”

Other emerging market economies such as Brazil and Russia have also performed badly over the last year.

Yet optimism was up on nearly all asset classes in the survey on the month apart from UK property. Shares in the Eurozone, US and UK all carried a more positive outlook.

A host of central banks have eased their policies, or delayed raising interest rates this year. The People’s Bank of China cut interest rates last month while the Bank of Japan in September announced it was switching its target to nominal GDP – the amount of cash spent in the economy.

The US Federal Reserve is still debating whether to hike in December after delaying in September and the European Central Bank has made numerous comments suggesting it will ramp up its asset purchase programme. Some economists are even betting on the Bank of England keeping rates at record lows until 2017.