Morgan Stanley analysts: There’s a one in three chance of Brexit – which could lead to recession, a divided Conservative party and second Scottish independence referendum

There is a one in three chance of the United Kingdom voting to leave the European Union, according to analysts at Morgan Stanley, who believe an "out" vote could lead to recession, rising inflation and uncertainty for the UK.

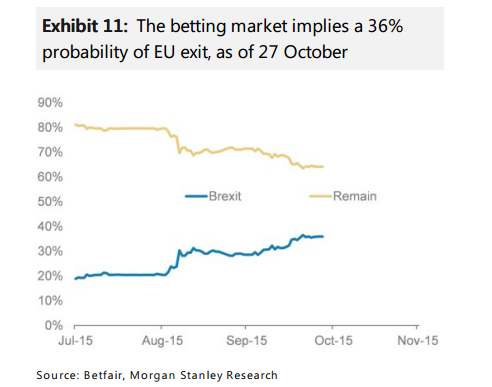

The investment bank has placed a 35 per cent chance on the UK voting to leave the EU in the upcoming referendum, promised by the end of 2017.

If that were to happen, the UK would be exposed to a "referendum shock" that could bring about a recession.

"If the UK votes to leave, we see a hit to economic activity and asset performance," Morgan Stanley's research said.

If a Brexit takes place, the economy will grow at just one per cent in 2017, and CPI will rise above the government's two per cent target, the research suggests.

Read more: UK is "yet to reveal details of its EU renegotiation plans"

Meanwhile, policymakers will have no choice but to use stimulus measures to prevent the economy going into freefall.

"Following the vote to leave, we would expect a sharp sell-off in UK assets – a referendum shock – that might lead to official intervention to smooth volatility," Morgan Stanley said.

With regard to trade, while the costs and benefits depend on the type of deal negotiated, the risks are "tilted towards the downside".

In a post-Brexit scenario, the analysts suggested a bespoke "Swiss style" agreement looks attractive from a UK perspective, since it reduces disruption and barriers to trade.

"But it is not clear it would be offered,and it appears to be very slow to negotiate– nearly 10 years passed from the Swiss rejection of EEA membership in December 1992 to the entry into force of the main bilateral agreement in June 2002."

And as other countries may not want to make a Brexit easy for the UK in order to dissuade other countries taking a similar course, a hard exit could occur, meaning there is a "significant risk of a disorderly and costly exit".

Read more: Bookies' odds show increasing probability of Brexit

However, the bank said it ultimately expects the UK to vote to stay in the EU as it doubts "there will be a majority for such a risky step". Secondly, the bank added, "we expect Cameron will succeed in negotiating some reforms, and will campaign to stay in – and according to the polls, that improves the support for staying by up to 20 percentage points".

The research also looked at the political implications of a vote to leave Europe as having the potential to divide the Conservative party, threatening "the stability of the government, particularly if senior ministers and MPs, including potential successors to Cameron, are prominent in the campaign".

And on top of that, the bank also said leaving the EU will increase the chances of a second Scottish independence referendum.