If you want a real scare this Halloween try predicting oil prices

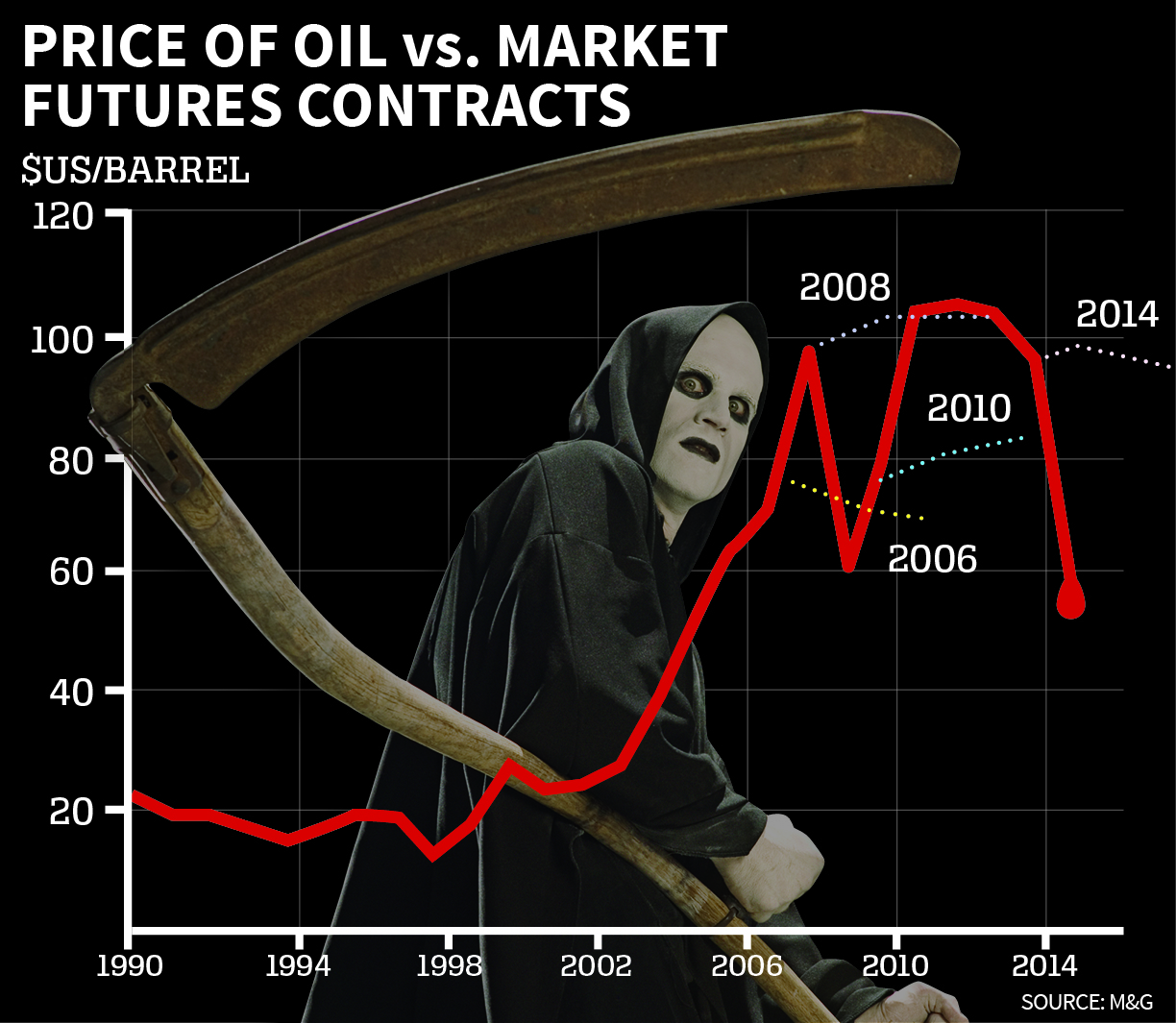

Forget scary movies this Halloween, consider instead this graph, which shows just how badly oil has performed, compared to market futures contracts, and just how impossible it is to accurately predict what prices will do. (The bloody red line tracks oil’s price, and the dotted lines represent futures contracts.)

Proving just how volatile the market is, oil massively outperformed futures contracts in 2006 and 2010, and then left investors disappointed in 2008, and this year, when prices plunged.

No wonder the IMF warned Saudi Arabia could be bankrupt in the next five years if oil remains at $50 a barrel, with such an unpredictable market, how are you supposed to plan a budget, or an investment portfolio? And increasing uncertainty in the Middle East will only put more pressure on prices.

And that’s not all to fear: global greenhouse gas emissions are increasing and look set to continue despite heated rhetoric ahead of the UN climate summit in Paris in December. The OECD estimates that greenhouse gas emissions will increase by more than 50 per cent by 2050, driven by a 70 per cent increase in carbon dioxide emissions from energy use.

Large emerging markets such as Brazil, India, Indonesia, South Africa and China, will account for most of the increase, with their collective greenhouse emissions almost doubling.

Energy demand is expected to rise by 80 per cent by 2050. Should this forecast prove accurate, global temperatures are expected to increase by between 3-6 degrees Celsius.

M&G Bond Vigilantes also predicts bad news for investors, as IMF analysis shows that all asset classes, from bonds to stock, are starting to move in the same direction, putting an end to traditional hedging techniques.

Divestment just doesn’t work as well when your bonds are going the same way as your equities, a trend which hasn’t gone away even when global volatility is lower. “A large scare in investment markets could really test the fragility of the financial system should asset values deteriorate across the board,” said Anthony Doyle, investment director in M&G’s retail fixed interest team.

US companies remain worryingly risk averse, putting money into share buy-backs, rather than investing in growth. Even though low interest rates since the recession have made it easier for companies to issue corporate bonds, there hasn’t been a corresponding increase in expenditure.

Doyle said: “Overwhelmingly, US companies have embarked upon equity buy-backs and M&A activity, which has helped shift the equity market higher. Only a small amount of proceeds raised by US companies in bond markets have actually been used for capital expenditure. This suggests that corporations remain hesitant to take risk, even in an environment where many perceive that the US economy is ready to withstand higher interest rates.”