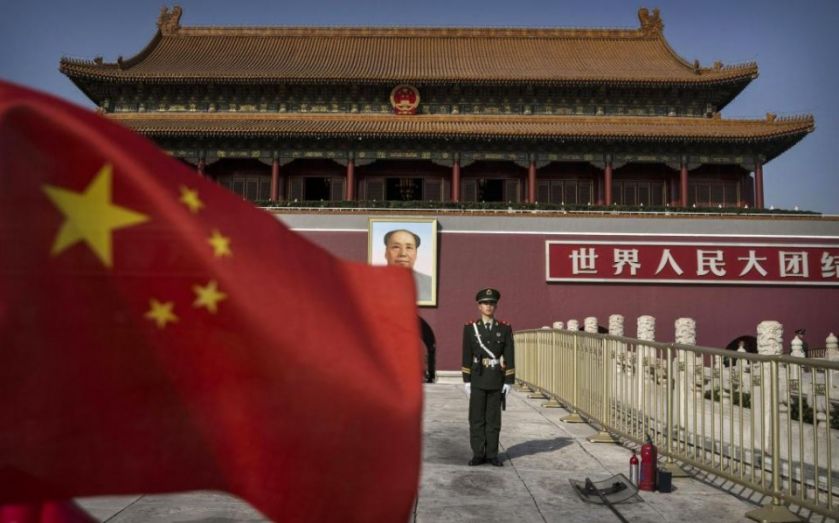

Unlimited upsides? Check. Too big to fail? Check. History tells us careful investors could be about to make millions in China

The Chinese government could be forgiven if it now feels rather pleased with itself. After interventions including banning negative reporting on markets, threatening to prosecute short-sellers, and ordering companies to engage in share buybacks, it has succeeded in arresting a stock market crash – albeit with a few bumps along the way. Not many governments would have even attempted such a manoeuvre, much less come close to succeeding.

But this means investors have the opportunity to make some serious money.

After all, the upside is unlimited (even after the recent bumps, the Shanghai market is up 71 percent on the year). And the downside has a floor underneath it, set by your government’s unwillingness to let the markets collapse.

We in the West know something about this scenario. In the late 1990s, for instance, it became clear that the US government was backstopping large American banks. The origins of “too big to fail” are a long story, but the seminal event was the failure of a hedge fund called Long Term Capital Management. The US government stepped in to coordinate an orderly resolution of the fund, not to save the fund itself but to ensure the survival of the nation’s largest investment banks.

From that moment on, the largest banks (including those that were not part of the federal deposit insurance scheme), began to enjoy several benefits: lower costs of funds compared to other banks, higher credit ratings, and most importantly, the ability to take larger and larger risks with other people’s money.

Almost all businesses take risks, of course; and most businesses take risks with other people’s money, whether raised from shareholders or bondholders. Some businesses, like hedge funds, take huge amounts of risk, and can obtain very high returns as a result. But companies that take large risks generally have to pay a premium for the money they borrow, to account for the risk. The banks, with implicit government support, did not need to pay such a premium.

The difference between high risks and low costs of funds was profit. Indeed, staggering amounts of profit: at the peak, the financial sector was earning 45 per cent of all the profits in the US economy.

So, dear Chinese investor, let this inspire you. I have only mentioned stocks so far, but actually, the government has recently stepped in with a variety of rescue packages. It has organised bailouts of at least two shadow banking fund management vehicles, and it has recently forced state-owned banks to continue lending to insolvent infrastructure and real estate projects.

Of course, the authorities are not fools. The Chinese government, recognising the possible perverse consequences of its actions, will attempt to limit the risks investors take (as it recently cracked down on the margin lending used to play the stock market, for instance).

But worry not. The US and global governments had, over the course of several decades established an elaborate and well tested apparatus to control bank risk-taking. It didn’t work. Such constraints just mean you have to be more creative. There are, after all, many ways to take risks.

"But didn’t it all end in tears?", you might say. Well, yes, it did. Our bankers took on more and more risks until the global financial crisis occurred. There was even then a bailout, but after that, we talked a lot about tarring and feathering our bankers, especially when elections rolled around. Meanwhile, we gave banking regulators carte blanche to harass bankers as a form of legal torture.

So you could stay out, and thus avoid the eventual crash, which will come when the risks get too big for even the Chinese government to handle.

But to my mind, that’s just leaving money on the table. J.P. Morgan stayed out of credit default swaps for mortgages, because their risk management team said the risk couldn’t be assessed accurately. That’s fine for the timid.

Better to take a page from the book of Goldman Sachs: they went in big, and pulled out just as the edifice was about to collapse. That is what we in the West call “smart money”. Their timing was impeccable (almost impeccable: they had bought a lot of insurance from AIG, which unexpectedly collapsed. Fortunately, the US government stepped in to make up the difference).

So history tells us to get in now, before the collapse. Those who were lending you money to use in stock market gambling will now be even more eager, as the government has shown its supporting hand. It’s just a question of getting around the controls. So, Chinese investor, risk on.

– Sam Wilkin is a business economist and the author of Wealth Secrets of the One Per Cent, published in the US by Little, Brown and in the UK by Sceptre