$220m reasons to keep your password safe

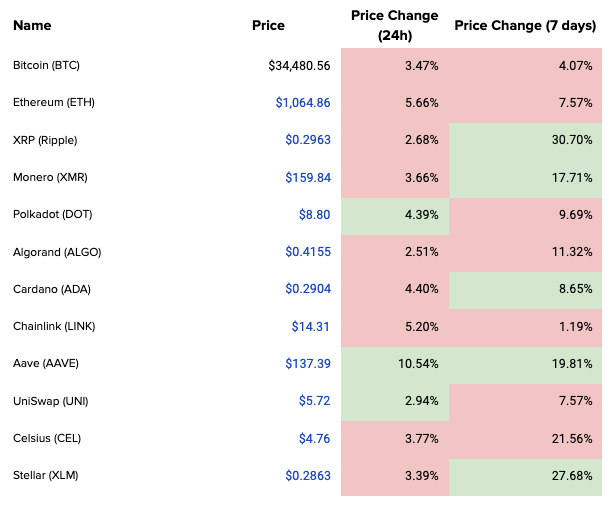

Crypto at a Glance

If you’re having a bad start to the day, spare a thought for San Francisco-based computer programmer, Stefan Thomas. Stefan made headlines around the world yesterday with his tale of forgotten password woe. He now has just two chances left to remember the password to a hard drive containing the private keys to a digital wallet that holds 7,002 bitcoin, which he accepted as a payment for a job back when you could get 1 bitcoin for around $5. Thoughts and prayers, Stefan.

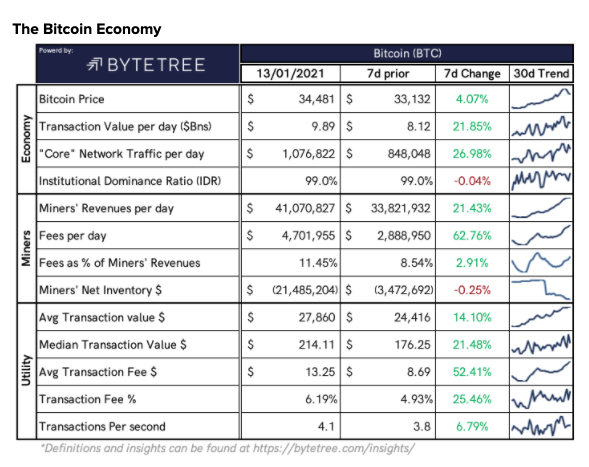

He might take a small crumb of comfort in the knowledge that whatever is on that hard drive is worth a good chunk less than it was last Saturday – although not that much. The bitcoin price is still hovering around the $35,000 level, with resistance forming at $36,000, and looks to have settled somewhat. Are we entering a period of accumulation before another push to $50,000?

It was better news for a number of alts – particularly Cardano, which briefly flipped Litecoin to temporarily join the top 5 biggest coins by market cap. Stellar is also still looking strong over the past 7 days and Aave continues to make gains. Even XRP is still up 30% over the week, which is still baffling given its recent legal predicament. Looks like the XRP Army is really keeping the faith.

In the Markets

What bitcoin did yesterday

We closed yesterday, 12 January, 2020, at a price of $33,922.96 – down from $35,566.66 the day before. It’s now been eleven days in a row that the price of bitcoin has closed at over $30,000.

The daily high yesterday was $36,568.53 and the daily low was $32,697.98.

This time last year, the price of bitcoin closed the day at $8,192.49 and in 2019 it was $3,661.30.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

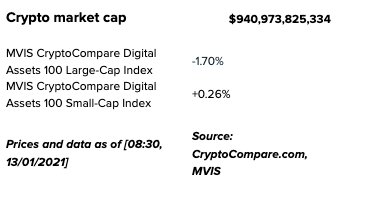

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $648,756,524,442, down from $678,876,091,509 yesterday. That makes it the 11th biggest asset by market cap. To put that into context, Gold has a market cap of $11.795 billion. That’s a lot of room for growth.

Bitcoin volume

The volume traded over the last 24 hours was $77,123,744,213, down from $111,582,160,990 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 89.66%.

Fear and Greed Index

The Fear and Greed Index continues its streak in Extreme Greed, although it’s down again from 84 to 78 today – its lowest level since 5 November, 2020. It’s important to remember that the index doesn’t usually stay this high for very long and could mean a correction is on the cards.

Bitcoin’s market dominance

Bitcoin’s market dominance stands at 69.16. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 60.97. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

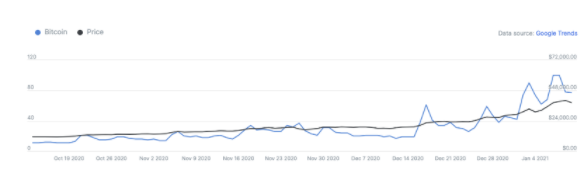

Google trends

The trend in Google searches over the last 90 days. Google shows this chart on a relative basis with a max score of 100 on the day that had the most Google searches for that keyword. The latest score is 77 – taken from 10 January.

Convince your Nan: Soundbite of the day

“I think the internet wants a native currency and I think bitcoin is probably the best manifestation of that so far,”

- Jack Dorsey, CEO of Twitter

What they said yesterday…

Keep your passwords safe, everyone

Not financial advice? Good to see she’s still getting work though

Not sure whether Mark Cuban and one of the Winkelvoss arguing over crypto use cases is bullish

or not?

Wow…

Crypto AM: Longer Reads

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM shines its Spotlight on EdenBase & its ‘Cognitive Revolution’

Crypto AM: Focusing on Regulation

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno