Five charts showing how we’re massively underestimating how much life costs, including children, house prices and pension costs

You're probably really bad at estimating how much things cost – but don't worry, most of us are.

As a nation we're drastically underestimating the cost of major life events such as having children, buying a house, or saving for retirement, according to a new poll by King's College and Ipsos Mori.

"It’s concerning that there are so many misperceptions from a significant proportion of the public about finances that directly impact the lives of individuals and their families," said Professor Denise Lievesley, the dean of social sciences and public policy at King's College.

1. Cost of buying a house

When it comes to the price of a property, we're pretty near the mark, but way off with our estimates of how much is needed for a deposit.

The average figure given by the public is £190,000, almost spot on the £194,166 average house price according to May's Nationwide index.

However, we think the average deposit is just £20,000 – pretty far off the £72,000 calculated by the Mortgage Advice Bureau. Just one per cent of the public guessed the cost was within this price range.

2. The cost of raising children

We all know pricey raising kids – but it turns out it's pricier than we think.

When asked how much it would cost to raise a child to the age of 21, the average guess was out by £179,000, and those who had kids of their own made even worse guesses, pegging the average cost at £40,000.

3. Saving for retirement

There's a huge gap between the amount needed to live comfortably in retirement (a £25,000 a year income) and how much we think our pension pot needs to be to make that happen. A gap of £176,000, to be exact.

4. The price of education

Most people peg student debt at a lot less than it is, guessing a figure that's less than half the actual amount graduates owe after leaving university. Those aged between 16 and 24 were closer, guessing £30,000, however, they were still drastically underestimating the price of higher education.

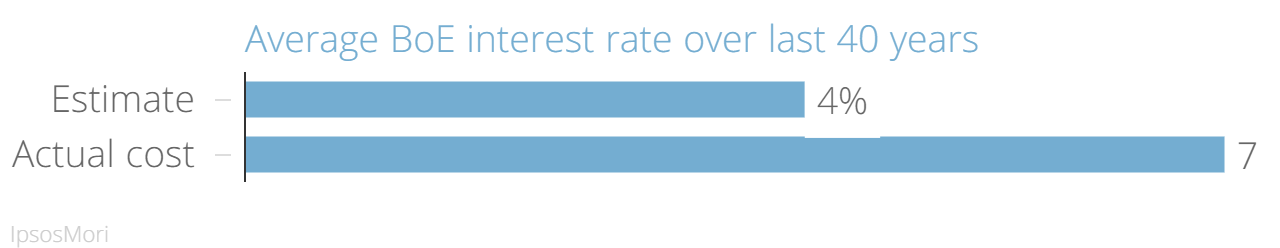

5. Interest rates

It's not just our own finances we underestimate either. When asked to estimate the average interest rate over the last 40 years, it was drastically less than the actual figure.

One thing we get right…

We're on the money when we're asked the classic question which has left many a politician stumped- how much is a pint of milk?