As Deutsche Bank share price jumps after bosses step down, can co-chief executives ever work?

Shares in Deutsche Bank were up more than six per cent in early morning trading, after its two chief executives bowed to shareholder pressure and announced their resignations.

Read more: Deutsche Bank bosses bow to pressure and quit

Anshu Jain and Jurgen Fitschen had been the subject of shareholder unrest over the bank's strategy. In recent months it has been hit by various penalties, including a £1.7bn fine over the Libor scandal.

Jain and Fitschen aren't the first pair of chief executives to bow out in less-than-dignified fashion. In fact, corporate double acts rarely work well.

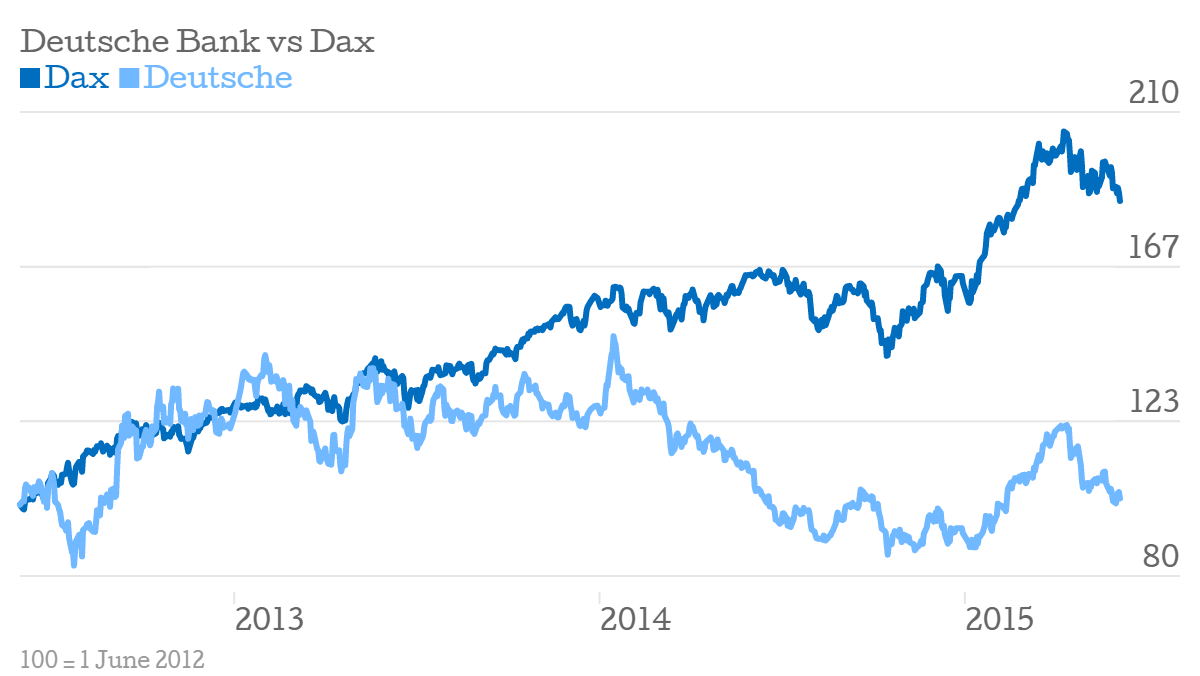

Deutsche is a case in point. During the three years Jain and Fitschen were in charge, the bank's shares have underperformed against Germany's Dax index.

But Deutsche isn't the only organisation which found two heads aren't better than one.

For years, Mike Lazidis and Jim Balsalie, who effectively co-founded Research in Motion (RIM), the parent company of BlackBerry (which was renamed BlackBerry back in 2013), got on well.

Having (arguably) invented the smartphone, for years RIM outperformed its index – but once Apple had got its teeth into its market, their lack of decisiveness meant RIM never managed to claw its way out of the hole it had created.

Here's how the company performed against during the five years before they resigned as co-chief executives in 2012.

But what of new recruits? Shareholders seemed largely unfased when Oracle founder Larry Ellison stepped down last September, appointing Mark Hurd and Safra Catz as chief executives (although technically, neither has "co-" in their title").

The pair are, presumably, still finding their feet as the leaders of one of the world's largest software companies. But shareholders are willing to give them the benefit of the doubt.