Disposable income: This is how your spending power breaks down by region

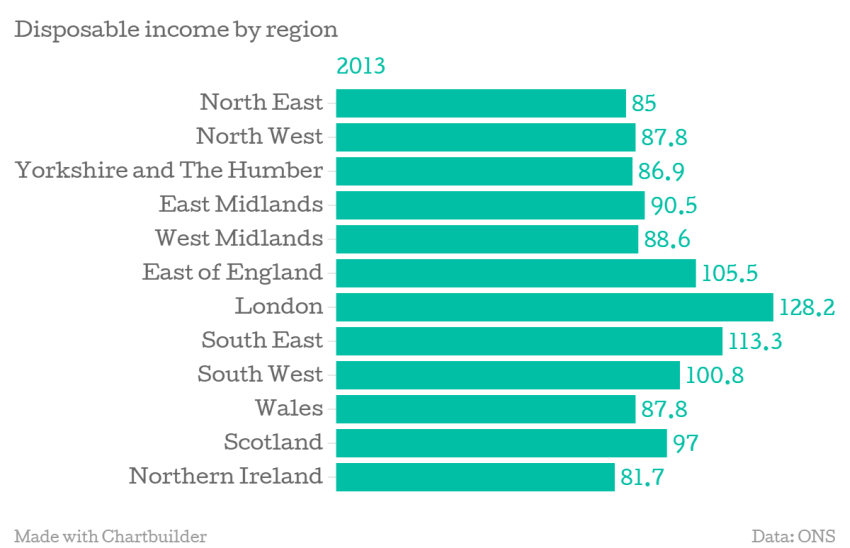

Between 1997 and 2013, people living in just four regions in the UK saw their disposable income increase when compared to the UK average.

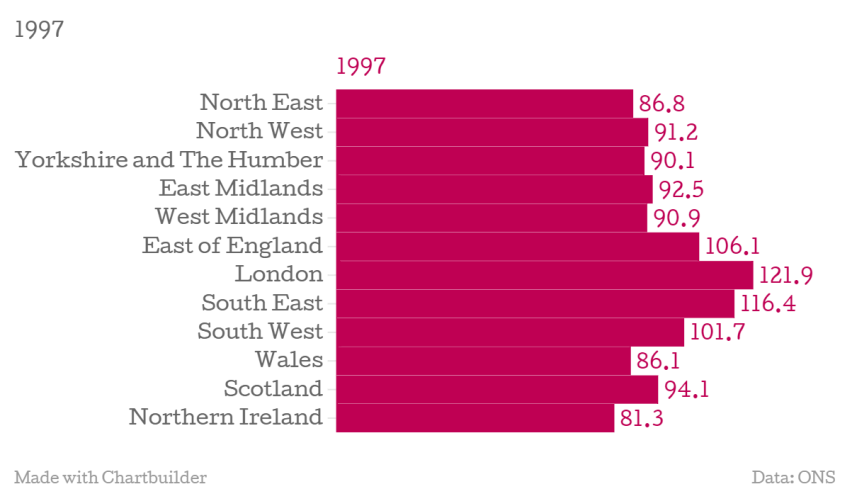

London saw the biggest jump, rising from an indexed level of 121.9 (where 100 is the average) in 1997 to 128.2 in 2013. Scotland, Wales and Northern Ireland all saw increases, but none of them edged above that all-important 100 mark.

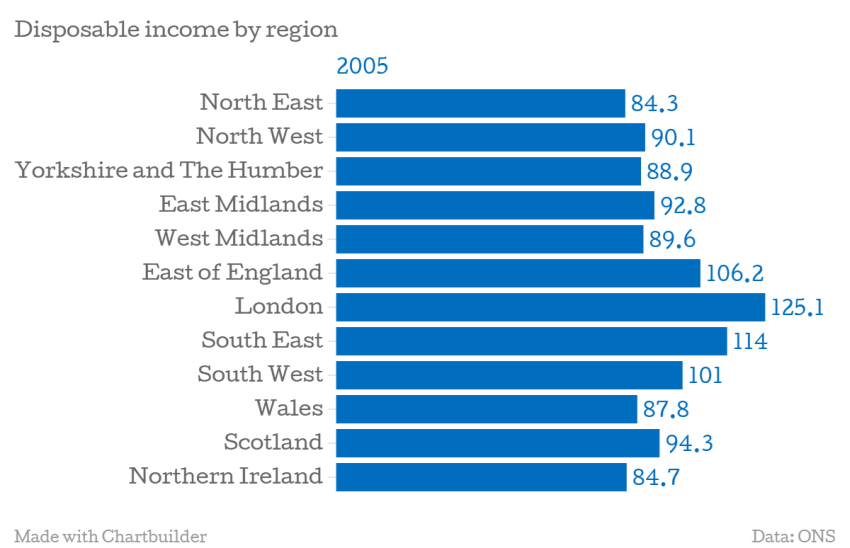

The following charts show the changes over the 17-year period broken down by region.

In fact, only London, the south east, east and south west are above that level – although the latter three have experienced a dip.

Those living in the West Midlands, north west, Yorkshire and the Humber and north east failed to climb to the UK average throughout the period.

People living in the West Midlands saw the highest increase in their gross disposable household income throughout 2013, rising 2.3 per cent.

It was a relatively good year all round however, with GDHI rising across the board. The lowest increase was in the north west, where people saw their disposable incomes rise by just over zero per cent.

London remains the region with by far the greatest spending power, with the average person having £22,516 a year to save or spend after essentials had been paid.

Northern Ireland had the lowest, with the average person having £14,347 a year.

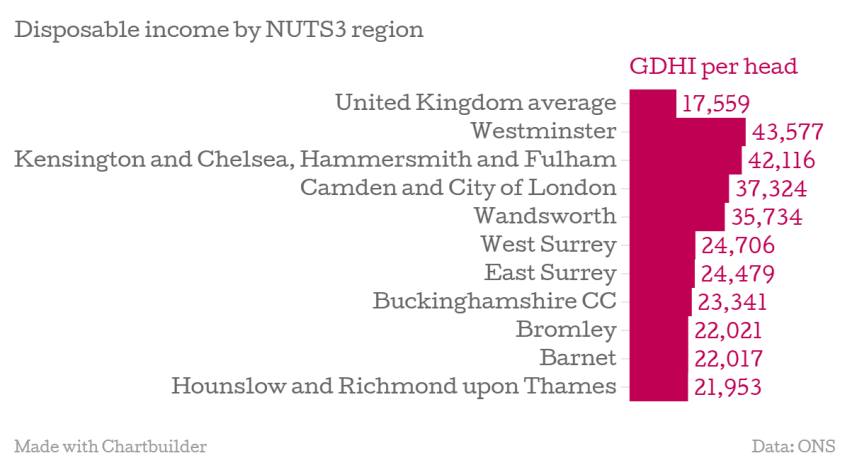

Breaking that down even further reveals the range even within London.

The average Westminsterite has £43,577 to spend, while those in Hounslow and Richmond-upon-Thames had a relatively lower £21,953. The chart below shows how much disposable income the top 10 regions in the country had in 2013.

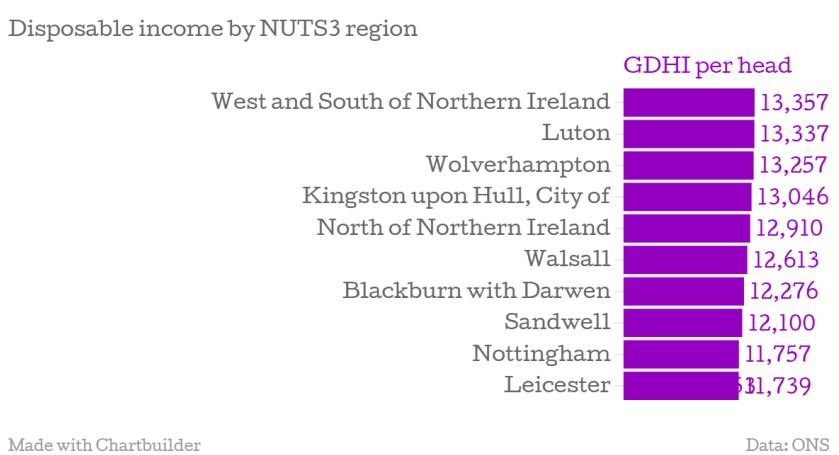

Meanwhile Leicester had the lowest in the country, at £11,739. The chart below shows how much disposable income the bottom 10 regions in the country had in 2013.

Of course when it comes to real spending power, this doesn't take into account variables such as localised rates of inflation and the prices of everything from your family home to your daily coffee. But it does give a sense of how much disconnect there is between London and the rest of the UK – and despite signs of growth that disconnect is getting stronger.