UK house prices: Scotland’s growth at its highest since 2007 as prices accelerate

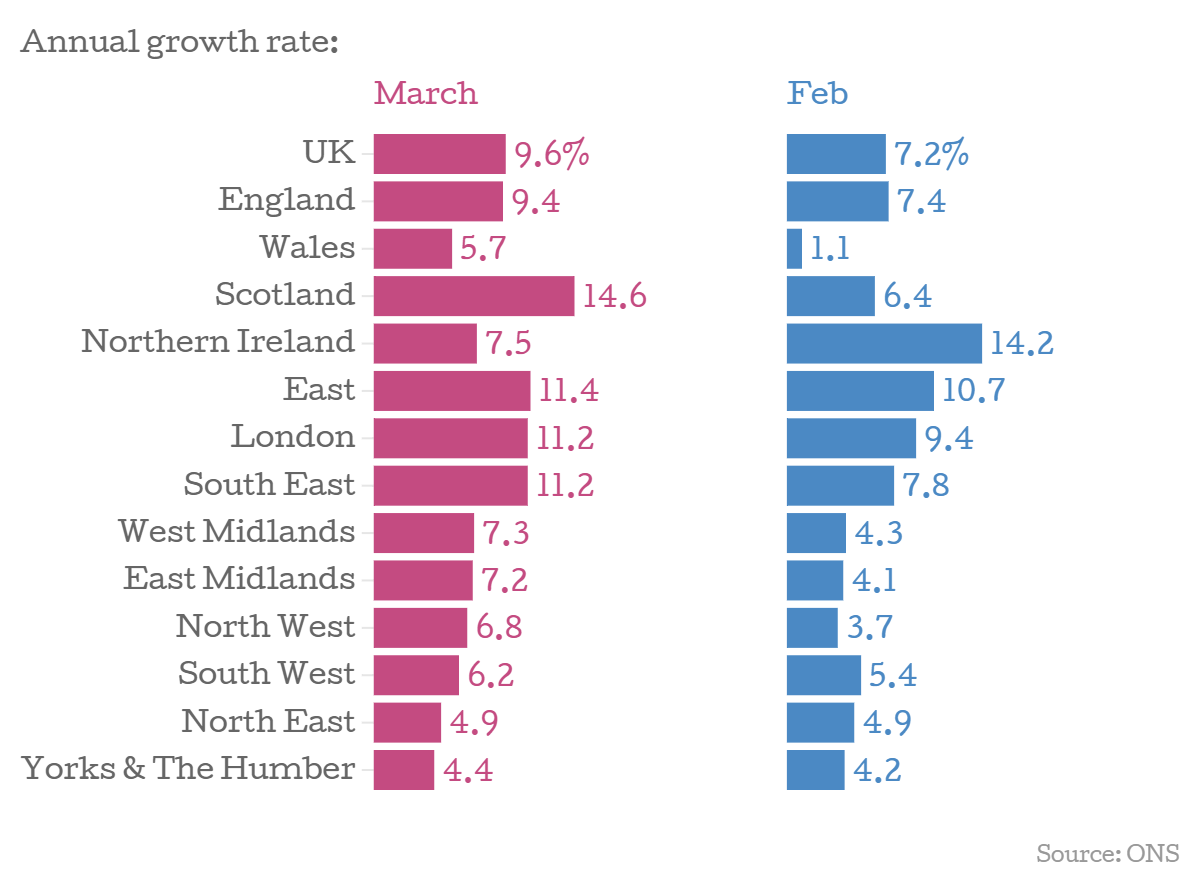

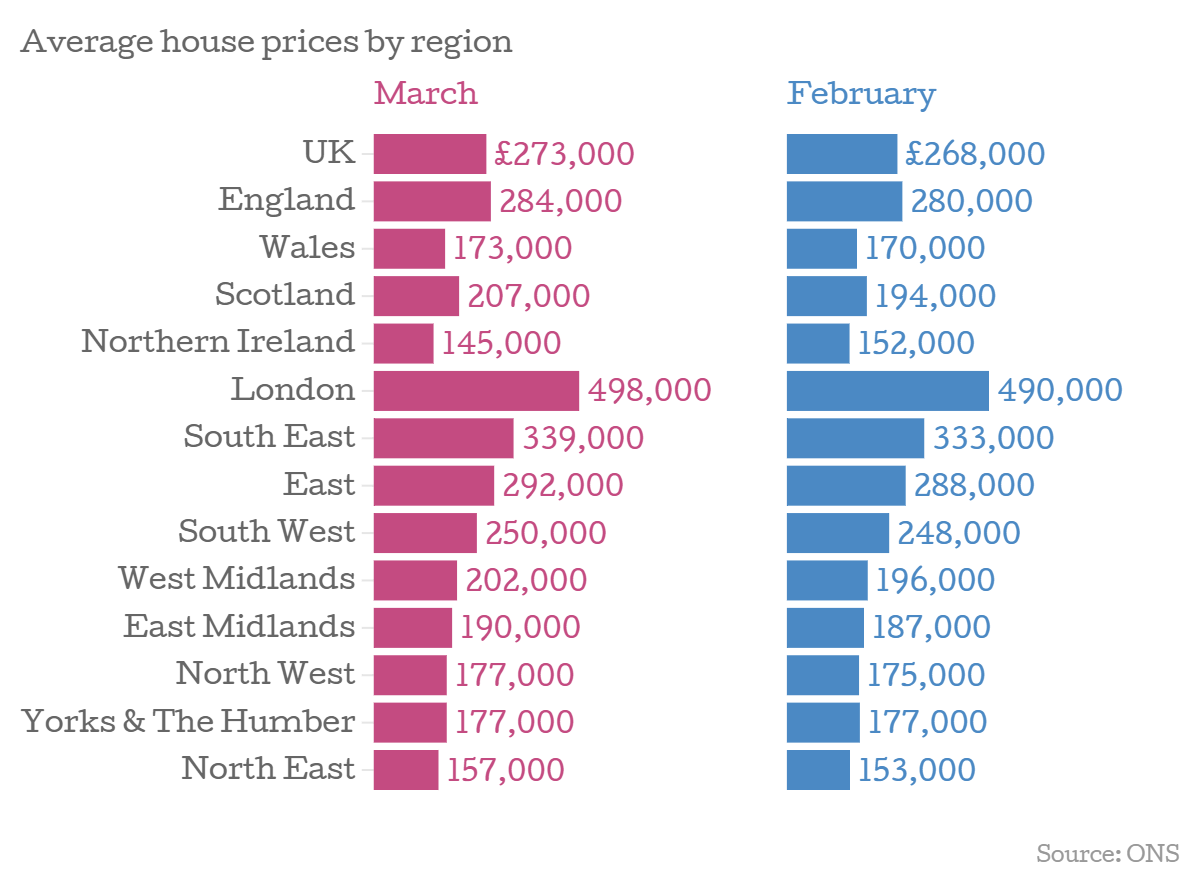

The UK’s house price growth rose to 9.6 per cent for the year to March, with Scotland the east of England and London driving the rise.

The figures

The 9.6 per cent rise in the UK for the year to March was 1.2 percentage points higher than the 7.4 per cent recorded in February.

The growth wasn’t evenly spread across regions: Scotland had the fastest growth at 14.6 per cent, while England’s prices grew at 9.4 per cent. Scotland’s stellar performance meant its prices grew at the fastest rate since July 2007.

On a monthly (seasonally adjusted) basis, prices in the UK grew 1.1 per cent between February and March.

Average prices are far higher in London, but growth in the capital has fallen behind the east, south east and Scotland. This isn't peculiar to the ONS data, other measures have shown similar trends.

Why it’s interesting

The ONS releases data based on mortgage completion, and it lags behind other indexes such as nationwide and Halifax, who have released data for April. Both showed higher monthly increases in April than in March – Nationwide’s one per cent in April beating 0.1 in March, while Halifax’s 1.5 per cent in April was more than double the 0.6 per cent growth it recorded in March (although the three-monthly growth rate slowed).

This means that the ONS’s data isn’t cutting edge, but it shows there is steady momentum growing in the market. This momentum could be due to a shortage of houses coming on to the market – a factor sure to increase demand.

This demand may wane later in the year as downward pressure comes into play. Stretched price to earnings ratios are one candidate for moderating growth – data from Halifax shows that the average price to earnings ratio rose to 5.2 in April, the highest since April 2008.

What the analyst said

Howard Archer of HIS Global Insight said:

We are lifting our forecast house price increase in 2015 to 6 per cent from 5 per cent, partly due to the increased upward impact on prices coming from a lack of properties on the market. We also suspect that the housing market will benefit from reduced uncertainty following the decisive general election result.

In short

Although house price growth is robust, it may well moderate going through the year as interest rate rises continue to hang over the market (even if they may not come until 2016) and tighter borrowing restrictions.