BP share price edges up as profits plummet 20 per cent, but still beat expectations

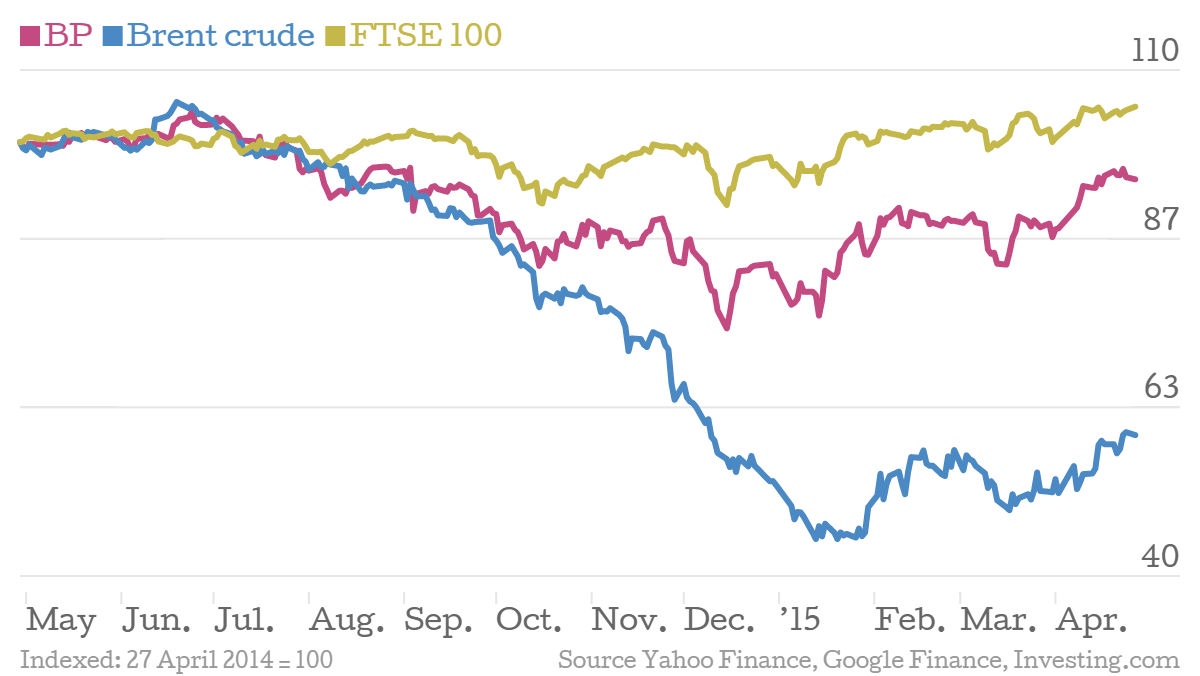

BP's share price rose slightly this morning, even as the company's results suffered from the effects of low oil prices. The energy giant’s underlying replacement cost profit was down 20 per cent for the three months ending 31 March, compared with the same period a year earlier.

That sounds like terrible news, but the company actually beat its earnings expectations: analysts expected earnings could fall to $1.28bn, but the came in at $1.6bn.

The news comes a day after the Conservatives let it be known they will oppose any foreign takeover of BP, believing that it is in the country’s interests that it have two big companies in the oil trade: BP and Royal Dutch Shell.

At the time of writing BP shares were up more than one per cent at 482p.

The figures

Not surprisingly, plunging oil prices were the main contributing factor to BP's profit fall, with the price of Brent crude averaging $54 (£35.40) during the three-month period, compared with $108 during the same three months in 2014.

What's more, the Henry Hub gas marker price (a measure of the cost of gas based on a US pipeline) averaged $2.99 per million British thermal units – a 40 per cent drop compared to the first quarter last year.

There was bad news from the upstream segment, with replacement cost profit totalling $600m, compared with $4.4bn a year ago. Included in the figures was a $545m loss on the company’s US upstream business, and $375 million costs associated with the cancellation of contracts for two deepwater rigs in the Gulf of Mexico.

The more encouraging news for shareholders was that it said it expects to pay a 10 cent quarterly dividend.

Why it’s interesting

The story is familiar: energy giants feeling the pinch from falling oil prices. BP has undertaken substantial restructuring of its operations, including the sale of some assets. It's planning to divest $10bn of assets before the end of 2015, $7.1bn of which are already in the bag, including an agreement to sell the company’s interests in the Cats pipeline in the North Sea.

The selling off of assets is a symptom of wider energy price ailments, with large companies such as BP struggling to maintain their sprawling empires. It has opened the UK industry up to takeovers and mergers, as companies seek to consolidate their positions. On example is the recent takeover of BG group by Shell, which created an oil behemoth.

BP’s North Sea pipeline sale is another example: the company is selling its interest in the programme to a private equity firm for £324m.

BP said

Bob Dudley, BP's group chief executive, said:

We are resetting and rebalancing BP to meet the challenges of a possible period of sustained lower prices. Our results today reflect both this weaker environment and the actions we are taking in response.

We are continuing to progress our planned divestment programme, we are resetting our level of capital spending, and we are addressing costs through focusing on simplification and efficiency throughout BP.

In short

The industry is in turmoil as oils prices shake up the established order. Not since 2009 have average prices across a quarter been so low.