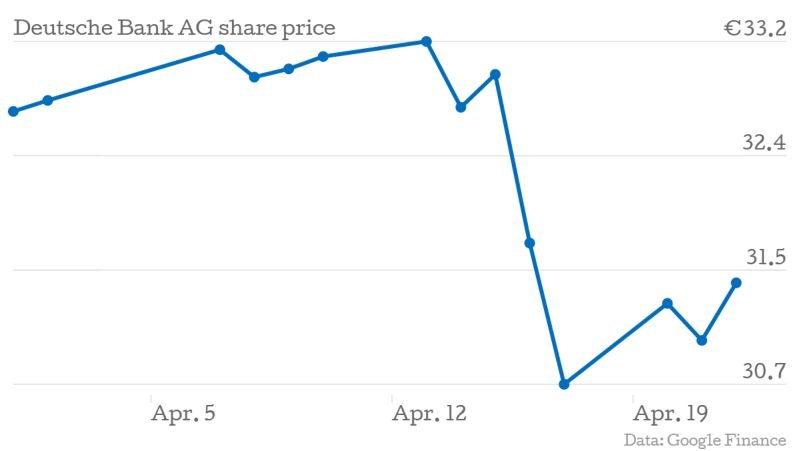

Deutsche Bank sets aside €1.5bn as Libor fine looms

Giant German lender Deutsche Bank last night said it is putting aside €1.5bn (£1.1bn) to pay for litigation costs incurred in the first quarter of the year.

But despite the extraordinary charge, the bank still expects to report a profit for the three-month period, on the back of “near-record revenues.”

The figure is thought to relate to fines for some of its traders’ attempts to manipulate key interest rate benchmark Libor.

Such a settlement with the authorities would follow similar fines levied on other banks since the summer of 2012, when Barclays became the first lender to pay up.

However, the British lender took a major blow to its reputation as a result of co-operating with regulators and seeking an early settlement. This discouraged other banks from reaching deals as quickly.

A spokesperson from Deutsche Bank declined to comment on the precise nature of the litigation. Deutsche will report its first quarter financials on 29 April.

Meanwhile, the lender is expected to soon announce a series of major structural reforms.

These are likely to include the sale of a retail banking business Postbank, and potentially its own-branded retail network.

Such a change would leave the main group focusing increasingly on corporate and investment banking, where it hopes to have a edge over European rivals.