RBS increases the size of its Citizens sale

RBS has increased the size of the tranche of US bank Citizens Financial it's planning to sell off, as investor demand showed promising signs.

That means the UK bank is likely to raise between $3.2bn (£2.1bn) and $3.7bn from the sale of 135m Citizens shares, up from the original plan to sell off 132.25m.

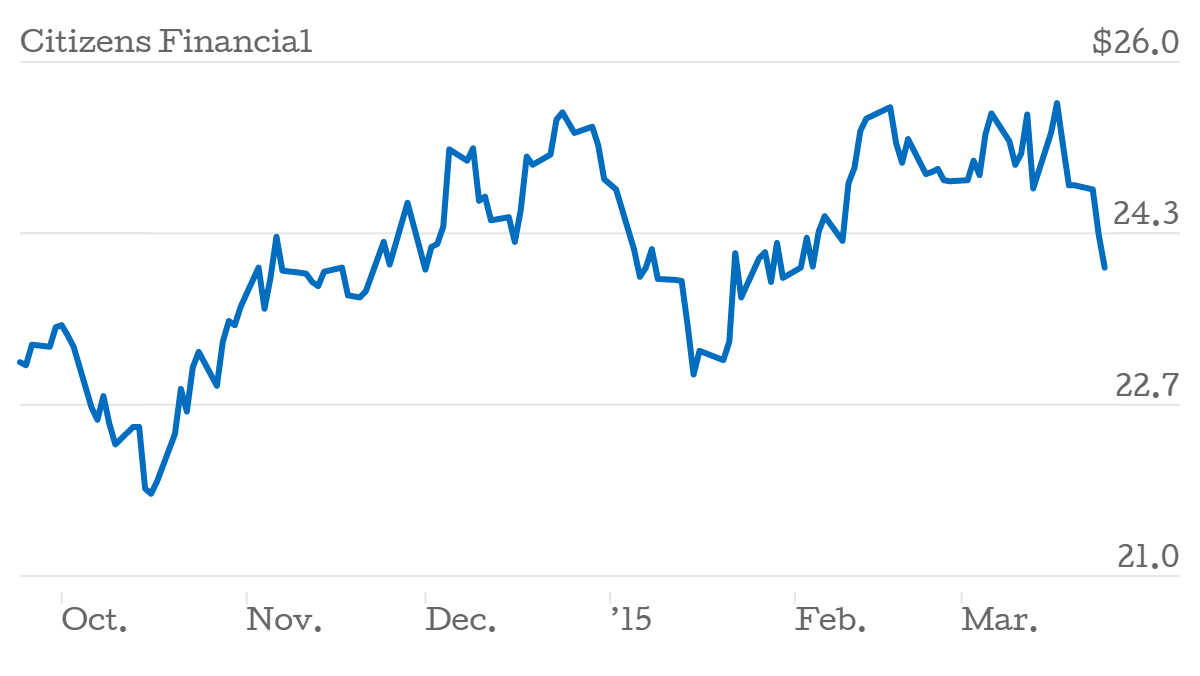

Under the plans, RBS will cut its stake in the US lender from 70.5 per cent to somewhere between 41.9 per cent and 45.6 per cent.  In recent days, shares in Citizens have fallen, from a high of $25.24 on Monday, when RBS announced the sale, to $24.00 at the close yesterday. Shares fell by a further 1.08 per cent in pre-market trading to $23.74 overnight – just shy of the $23.75 RBS is offering its shares at.

In recent days, shares in Citizens have fallen, from a high of $25.24 on Monday, when RBS announced the sale, to $24.00 at the close yesterday. Shares fell by a further 1.08 per cent in pre-market trading to $23.74 overnight – just shy of the $23.75 RBS is offering its shares at.

As part of its plans to extricate itself from the group by 2016, RBS floated Citizens in New York in September last year.

Ross McEwan, RBS' chief executive, said the sale of Citizens was an "integral part of the RBS capital plan".

It will help us to create a stronger, safer, UK focused bank that can better serve the needs of its customers.