UK house prices: Housing shortage means property costs grow at fastest rate in 10 months

Has a bombshell has landed in the housing market this morning? Britain’s chronic shortage of homes is the main driver behind the average asking price for a property surging by £5,729, or 2.1 per cent, this month, after what had looked to be a tempering market.

The 2.1 per cent rise in February is up on January's 1.4 per cent, and takes the annual rate of change to 6.6 per cent, which, despite February's boom, is down from 8.2 per cent. This is largely due to a booming second month last year, when the average price grew 3.6 per cent.

According to Rightmove, which keeps a house price index on the asking price of homes across the country, a number of estate agents reported that stock levels of quality properties are at their lowest ever. The evidence, although anecdotal, reflects what we’ve known for a time: Britain needs more houses.

This was backed up by January 2015 being the busiest ever month on Rightmove’s site, although there may be other factors at play, not least the perceived beginning of a Zoopla decline. Zoopla is coming under pressure from OnTheMarket, a new website, which is forcing users to choose between RightMove and Zoopla. Many people seem to be choosing Rightmove.

Miles Shipside, Rightmove director and housing market analyst said:

For the right property at the right price, demand is outstripping supply and leading to some further upwards price pressure. However there is a limit to what the majority are willing or can afford to pay, especially with the tighter lending criteria. In locations where there is a tight-stock market some different tactics are required for a successful move as competition gets fiercer for quality homes as demand increases.

The increased demand can be summed up in another statistic too: there has been a 31 per cent increase in the number of transactions in England and Wales over the last two years, a figure streets ahead of the 11 per cent rise in the number of properties coming to market.

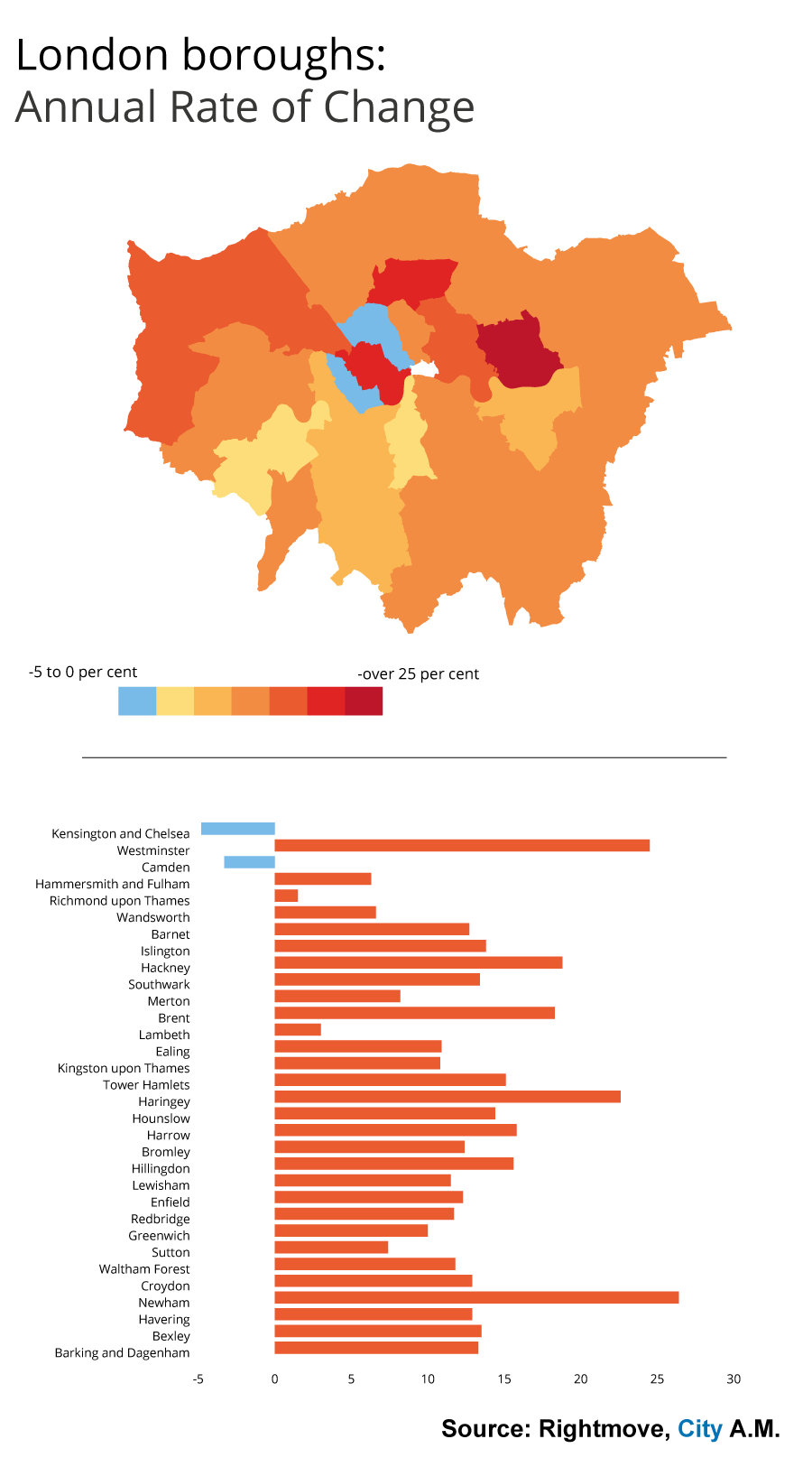

London is always a different beast when it comes to property. The capital's average price grew from £566,404 in January to £582,438 an increase of 2.8 per cent. That makes the annual change 9.7 per cent, the fastest in the country.

Not all boroughs are rising however, as the below map shows: