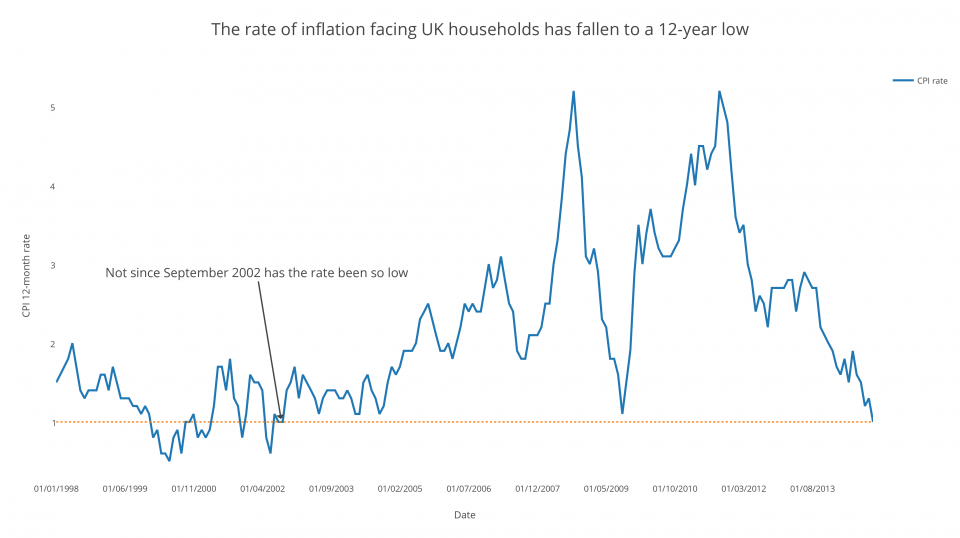

UK inflation falls to lowest rate since 2002 thanks to plumetting oil prices

UK inflation fell to its lowest rate since 2002 in November after petrol costs were cut due to plummeting oil prices.

The rate of consumer price growth fell to one per cent last month, the lowest rate for 12 years and down from a 1.3 per cent rate in October.

Any hopes investors had for a hike in interest rates from a historic low of 0.5 per cent will be put on hold.

David Kern, chief economist at the British Chambers of Commerce, said the monetary policy committee (MPC) could easily resist calls for an increase in rates.

Kearn said: “While weak energy and food prices are pushing down inflation, domestic pressures are also easing. A rise towards the two per cent inflation target is unlikely well into 2016.

“These figures will make it easier for the MPC to resist calls for higher interest rates. The UK recovery is still facing challenges.”

While weak energy and food prices are pushing down inflation, domestic pressures are also easing. A rise towards the two per cent inflation target is unlikely well into 2016.

These figures will make it easier for the MPC to resist calls for higher interest rates. The UK recovery is still facing challenges.

In November, the Bank of England (BoE) warned that inflation would fall below one per cent over the following six months. This would force governor Mark Carney to write a letter of explanation to chancellor George Osborne as the rate would be over one percentage point off the bank’s target of two per cent.

Oil prices have tumbled in recent months – below $60 per barrel today – contributing to reduced transport costs. The price for fuel and lubricants fell by 5.9 per cent for the year.

Furthermore, the race to catch Christmas shoppers with big sales, including the biggest “Black Friday” in the UK’s history, has contributed to the fall in costs of items such as computer games, toys, clothes and photographic equipment.

James Brown, partner at pricing experts Simon-Kucher & Partners, commented:

With Black Friday becoming a fixture in the UK retail calendar, and customers learning to expect early Christmas discounts, we’re inevitable going to see pressure on retailer margins over a traditionally strong period.November saw further falls in the price of motor fuel driven by tumbling crude oil prices. With retailers eager to pass on the decreases, consumers are already seeing the benefit at the pumps. Indications from Opec suggest production won’t be cut meaning no increases in the short term.