2023 Company ESG Data: Winners & Losers

At Integrum ESG, we pride ourselves on our data being dynamic and not static like many of our more established competitors. We ensure that all sustainability scores and data on our innovative Platform is updated within days of a company publishing new materials.

By ensuring our data is constantly up-to-date and of the quality expected from our investor clients, this also allows us to take a comprehensive and objective view over holdings ESG data – being able to easily spotlight companies which have improved significantly and those whose scores have dropped in the past year.

We previously posted on the more general improvements we saw from companies in 2023, which you can read here: https://www.cityam.com/leaving-bad-disclosure-in-2023/

For this article, we wanted to narrow in and look at specific holdings where we either saw a great improvement or a disappointing slide in a company’s ESG scoring – and then deep dive into the reasons why.

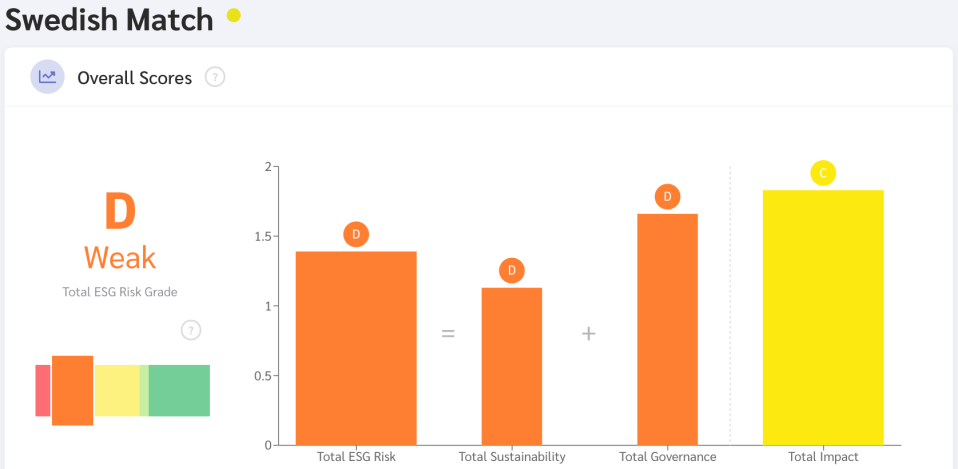

Swedish Match [SWMAY]

Industry: Food & Beverage

Sector: Tobacco

Overall ESG Score: 1.96 -> 1.39

Swedish Match is a Swedish multinational tobacco company, known for being the largest SNUS manufacturer in Scandinavia.

In their most recent sustainability report:

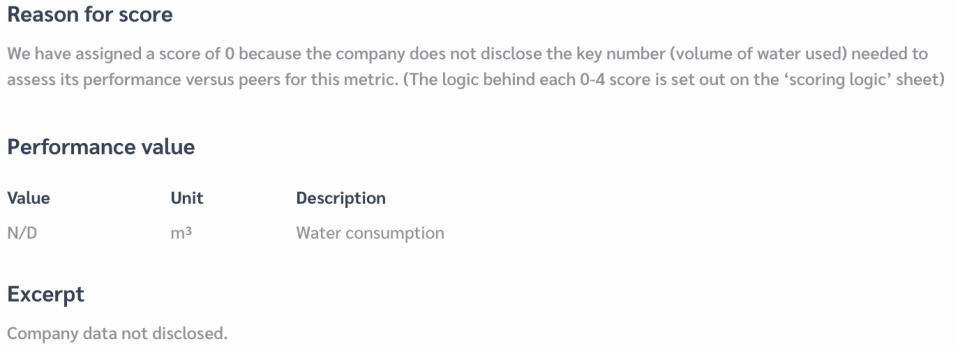

https://www.swedishmatch.com/globalassets/documents/sustainability/sustainability-reporting-archive/2022_swedishmatchsustainabilityreport_en.pdf, the company did not publish figures related to their energy consumption having done so in previous years.

Furthermore, the company claimed in last years’ report that they “address potential issues related to water use from our tobacco supply chain through participation in STP”, the STP being the ‘Sustainable Tobacco Programme’.

https://spcommreports.ohchr.org/TMResultsBase/DownLoadFile?gId=34136

Nevertheless, their report and website lack specific policies addressing water consumption risks, and they do not disclose quantitative figures on the volume of water used.

Please see a full detailed ESG report PDF on Swedish Match [SWMAY]

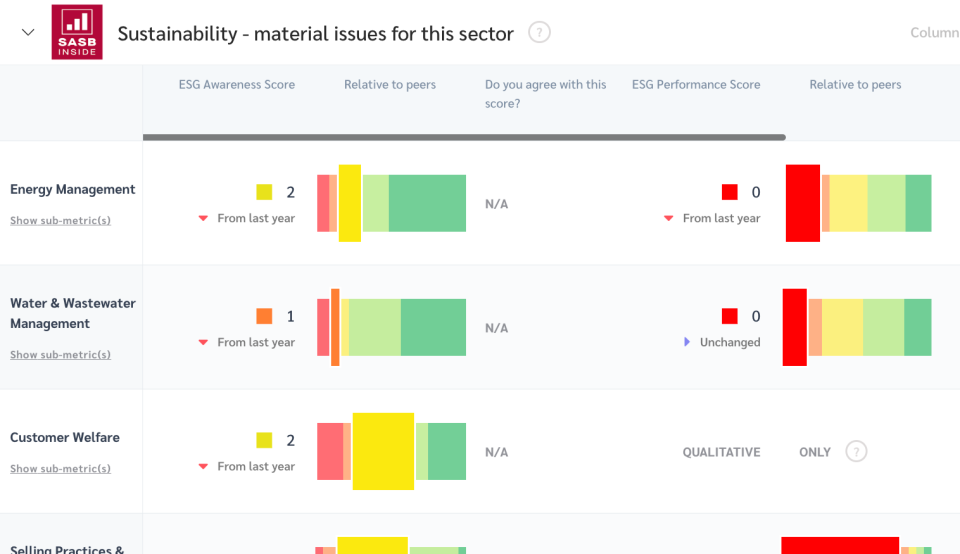

ProPetro Holding [PUMP]

Industry: Extractive & Minerals Processing

Sector: Oil & Gas – Services

Overall ESG Score: 0.69 -> 2.12

ProPetro Holding integrated oilfield services company based in Texas, providing hydraulic fracturing and other complementary services to upstream oil and gas companies engaged in the exploration and production (E&P) of North American oil and natural gas resources.

In October 2023, the company published their first ever stand-alone sustainability report:

Please see a full detailed ESG report PDF on ProPetro Holding [PUMP]

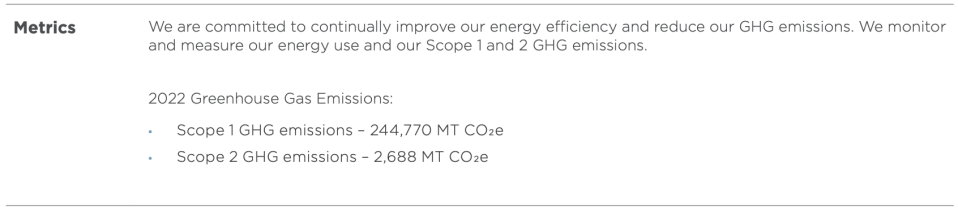

The report was the first time the company disclosed data on a number of different metrics, including;

- Their scope 1 & 2 GHG emissions(totalling 247,458 tco2e)

- Employee safety incidents (total recordable incident rate of 0.66)

- Fines from bribery or corruption ($0)

GHG Emissions

All of this increased disclosure led to the company almost quadrupling their ESG score.

Please see a full detailed ESG report PDF on ProPetro Holding [PUMP]

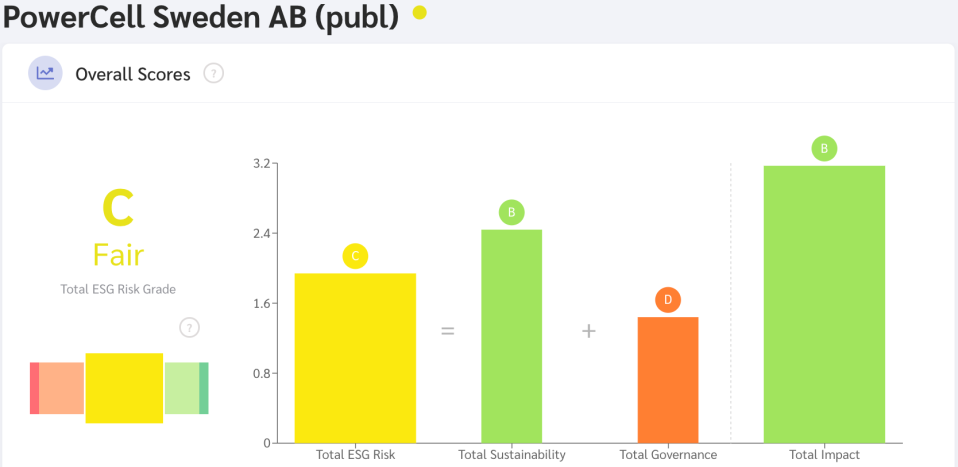

PowerCell Sweden [PCELL.ST]

Industry: Renewable Resources & Alternative Energy

Sector: Fuel Cells & Industrial Batteries

Overall ESG Score: 0.78 -> 1.94

PowerCell Sweden is a Swedish company engaged in the development, manufacture and sales of power systems with fuel cell and reformer technology.

In their 2022 annual report, PowerCell provided only minimal sustainability information across a mere two pages, with limited policy details and a lack of concrete numerical disclosures.

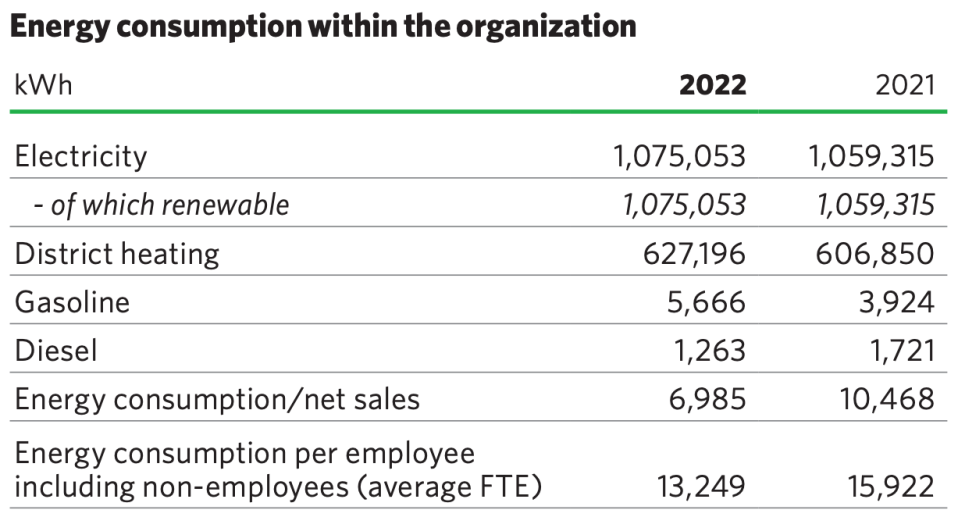

As of March 2023, the company marked a significant shift by releasing its inaugural sustainability-focused report (https://powercellgroup.com/reports/annual-and-sustainability-report-2022/), disclosing significant performance metrics and comprehensive sustainability policies.

The data disclosed included:

- Energy consumption

- Employee safety incident figures

- Product design & lifecycle management

- Materials sourcing & efficiency

This increased disclosure led to PowerCell’s ESG score increasing by more than double.

Please see a full detailed ESG report PDF on PowerCell Sweden [PCELL.ST]

About Integrum ESG

Integrum ESG offers a one-stop solution for investors looking to integrate Environmental, Social and Governance data into their research. Their objective rules-based scoring ensures that there is no room for analyst subjectivity to influence our ESG ratings.

This level of transparency and granularity allows thorough interrogation and most importantly, an understanding of how the ESG risks may have changed.