| Updated:

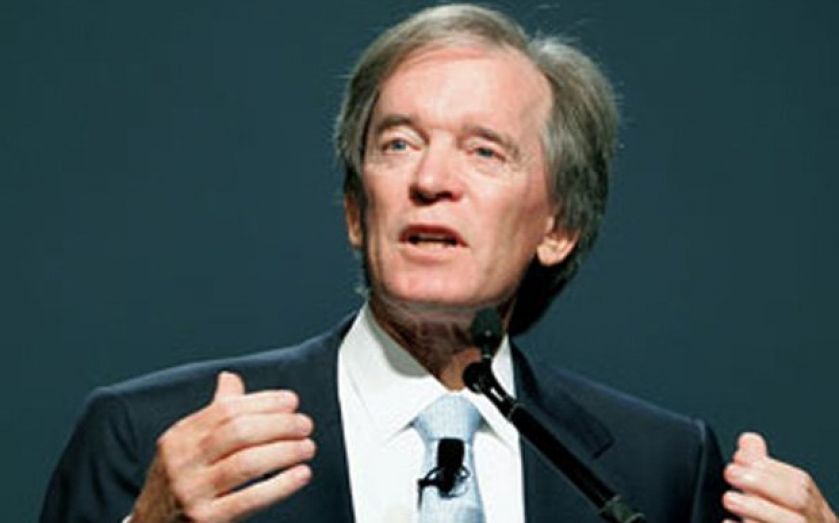

Pimco reveals £14.5bn outflows after Bill Gross’ shock exit

Investors have left Pimco funds in their droves following the surprise exit of “bond king” Bill Gross, admitting record outflows of $23.5bn (£14.5bn) from its flagship fund.

Pimco this morning revealed the largest daily exodus from the Total Return Bond fund took place on the day of Gross' resignation at the end of last month “while outflows on the two following days were considerably smaller”.

The fund, which is now being managed by newly-promoted chief investment officer Danial Ivascyn and portfolio managers Mohsen Fahmi and Saumil Parikh, had $222bn assets under management at the end of August.

Pimco sought to reassure remaining investors that it had the situation under control, saying:

"The core fixed income market in which the Total Return Fund invests is one of the largest and most liquid markets in the world, trading on average $700bn of securities a day.

"Moreover, the fund is well positioned to meet potential redemptions. Short-term cash management is an area of expertise and strength at Pimco."

It also flagged its Income Fund, which has had net inflows this year of more than $6.5bn, adding: “As we engage our clients around the world, we are confident that the vast majority of them will continue to stand with Pimco as we demonstrate why we have earned the reputation as one of the world’s premier investment managers.

Legendary fund manager Gross revealed he was leaving to join competitor Janus Capital in a surprise announcement nearly two weeks ago and will take up responsibility for its Global Unconstrained Bond Fund from October 6.

At the time, we noted the impact it was having on the close-ended funds within the group – and conversely Janus Capital's share price. After jumping 38 per cent on the day to $15.35 per share, it has edged down to around $14.4.

He left just days after it emerged the company was under investigation by the US Securities and Exhange Commission (SEC) into irregularities over its exchange traded funds (ETFs). It was later reported the Pimco board may have been preparing to get rid of him itself.