130 profit warnings triggered by COVID-19

I’m not even sure where to begin. I think I’ll start with my week in numbers…

On Monday…UK quoted companies issued as many profit warnings in a day as they did in the whole of April 2019

On Tuesday….8 FTSE Retailers warned, the sector’s average quarterly total in 2019

On Wednesday, by 10am…5 FTSE Household Goods and Home Construction companies had warned, one more than the whole of Q1 2019

Unprecedented numbers…

UK quoted companies had issued 130 COVID-19 related warnings as of 10am, Wednesday 25 March. That’s around 10% of the whole of the Main Market and AIM.

Read more: COVID-19 – the first test for purposeful business?

To put that in context, even if we just considered COVID-19 warnings, this would be a record-breaking quarter. And let’s not forget how many profit warnings we saw in January, with numbers already up by 50% year-on-year by the end of the month.

So, there’s no doubt that we’re heading for a record total in Q1 2020. That’s a given. What’s taken profit warnings to a new level in the last week has been the impact of social distancing, and then, in the last few days, partial lockdown.

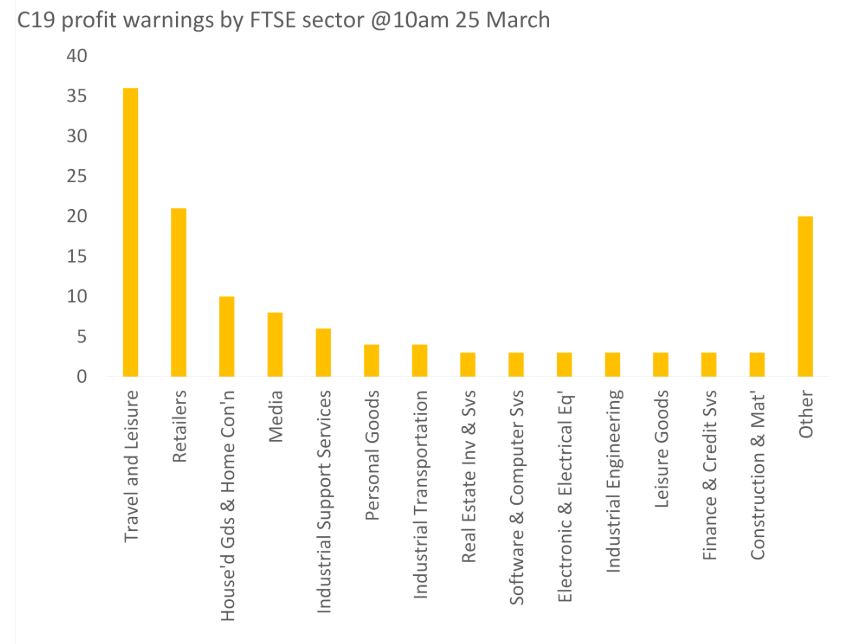

This has effectively halted operations across many consumer sectors, driving FTSE Travel & Leisure warnings to extraordinary levels. This week we’ve also seen a further spike in warnings from FTSE Retailers and FTSE Household Goods and Home Construction – especially in sub-sectors that cannot easily (or at all) mitigate with online sales, such as house builders and motor dealerships.

It’s these FSTSE sectors that have seen close to and over 50% of all quoted companies warning on COVID-19 in Q1 2020 so far…

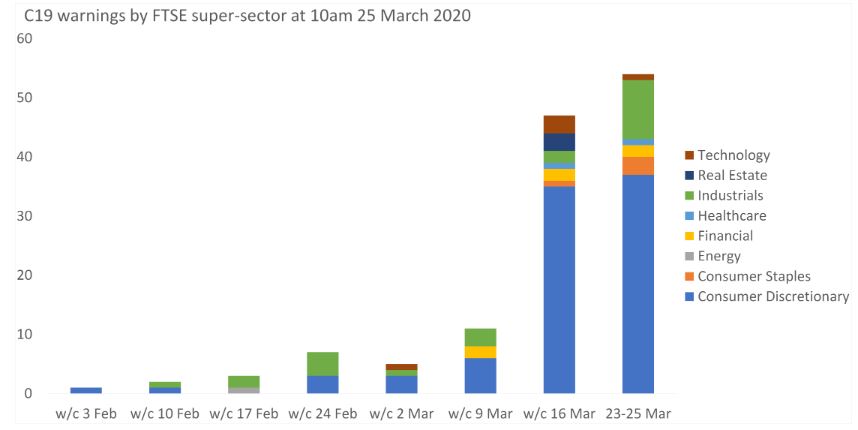

You can see the impact of social distancing and partial lockdown in the time pattern of warnings in the chart below, with 47 warnings last week and 54 up to 10am on Wednesday. You can also see the significant spike in warnings from Consumer Discretionary sectors – Travel & Leisure, Retailers, Media etc since the start of last week.

But, what’s also really noticeable here is the increase in profit warnings from industrial sectors in the last three days, such as – FTSE Construction & Materials, Industrial Support Services, Electronic & Electrical Equipment.

Industrials sectors led the initial COVID-19 warning figures, hit by disruption to Asian supply chains. Now, we’re seeing the knock-on impacts of companies halting capex and closing factories and construction sites across Europe. It’s here that I expect to see more activity as we see these second-round impacts spread across the economy.

Finding help

I think I’m not alone in having to keep pinching myself. The magnitude of what is happening – expressed in a small way in these figures – is immense and the situation continues to evolve. But, our approach remains focused on four fundamental principles:

- People and society: Human health comes first. This is as much of a humanitarian threat as it is a business and economic threat.

- Business continuity: We think it’s important that companies keep a trading mindset and take decisive and immediate action – with an eye to the future. Register for our managing business continuity webcast here.

- Financial viability: Organisations need to understand how they can pull the levers available to help them to manage and control liquidity.

- Stakeholder management: This is a complex situation with several stakeholders who need to be engaged and informed.

Read more: COVID-19 – a framework for business response

It’s important to remember is that help is out there. Over the past few days, the UK Government has announced – and has started to put in place – measures aimed at minimising the impact of COVID-19 on public services, individuals and businesses. Listen to a recording of our 25 March webcast which explores financial viability and government support, to help businesses understand what is available.

Read more: Tracker of stimulus and policy measures for global governments

For materials and insights on the impact of COVID-19 for UK businesses, visit ey.com/uk/covid