Trying to sell your house? A third of homes in some London boroughs have cut their asking prices

Another sign London's housing market might have hit its peak – after new research suggested sellers of as many as a third of homes in some parts of the capital cut asking prices.

The research, by property analysis firm Propcision, found sellers in Kensington and Chelsea were the worst-hit, with asking prices on a third of homes being cut.

Kingston-upon-Thames came second, with 30 per cent of asking prices cut, while Hammersmith and Fulham and Wandsworth both took third place – 29 per cent of asking prices were cut in both boroughs.

But Propcision pointed out that cutting asking prices didn't necessarily equate to falling house prices – in many cases, house prices were actually static.

[custom id="139"]

"The upward trend prime central London enjoyed for the past few years has started to show signs of resistance. This is typically associated with the start of correction although not necessarily a downward trend," said Michelle Ricci, Propcision's co-founder.

"We feel the data suggests asking prices are holding steady with levels seen in the past six months. However, that said, there are particular areas of vulnerability that may start to show demonstrable evidence of a downward trend – most notably new-builds.”

However, the data also suggested if there is a correction, new-builds in London's most exclusive areas are likely to be the worst-hit, thanks to changes to tax and stamp duty, as well as the weakening pound.

On Friday Candy & Candy, the high-end interior designer behind One Hyde Park, one of London's most expensive residential schemes, filed figures showing in had fallen into a loss in 2015.

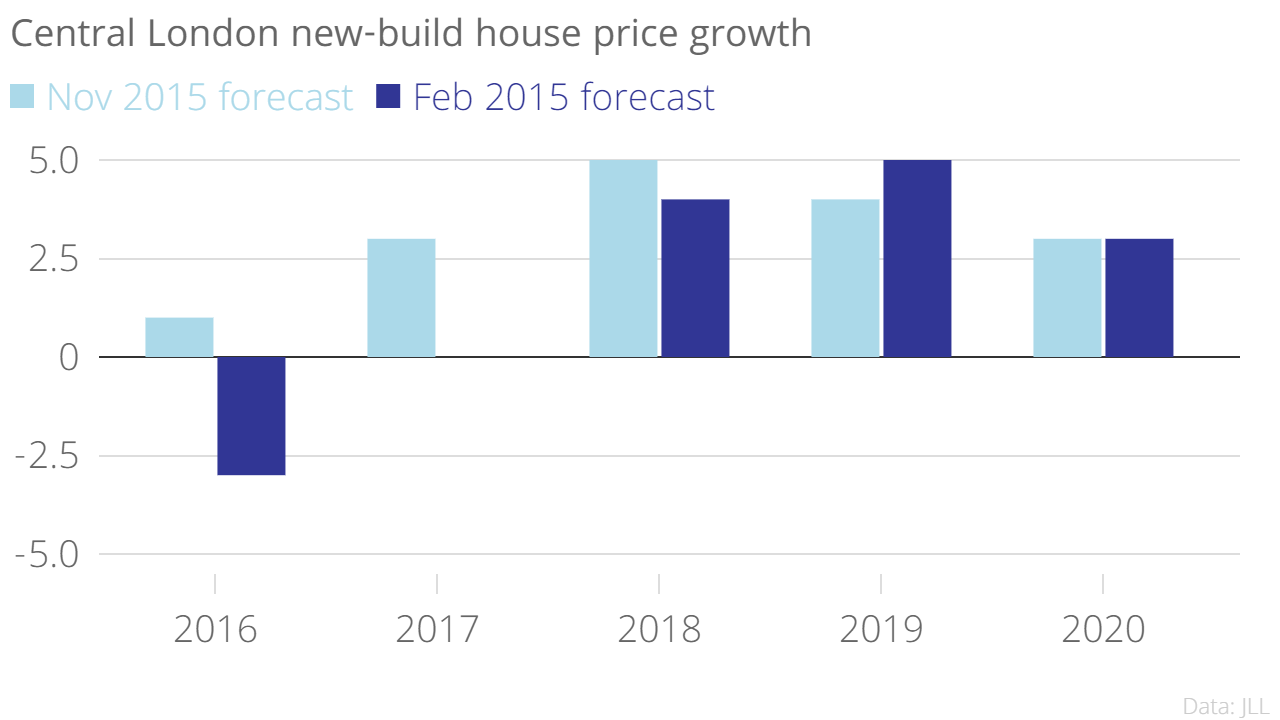

And in February, property services giant JLL cut its growth forecast for the capital's high-end new-build homes, saying new-build house prices are likely to fall 2.6 per cent in 2016, with flat growth next year.

“It has already been observed that certain pockets within central London postcodes have undergone sharp asking price reductions for new builds," Ricci added.

"However, values still remain relatively high. We are monitoring these areas for evidence of accumulation of housing stock alongside further reductions.

"If this proves to be the case, then the market could change from “steady” to downward for properties fitting certain characteristics. This may subsequently affect other areas of the market. ”